Archive for May, 2013

“Weiner Holder” – Hard left in 2016?

Posted by rabman13 in Bain Report, Politics, The Bain Report on May 31, 2013

“Weiner Holder” – Hard left in 2016?

There’s a lot of talk who will run for President in the next election. Forget about the “Hillary Michelle” team, the 2016 Democratic Dream Ticket is “Weiner Holder!”

In Detroit Former Michigan Supreme Court Justice Diane Hathaway Sentenced

Posted by rabman13 in Bain Report, Politics, The Bain Report on May 28, 2013

Is Justice Really that Blind? It is if you’re Politically Connected!

In the political arena the lobbyist say’s to the politician are you for or against a certain issue. The politician say’s to the lobbyist which way should I be? The lobbyist say’s it doesn’t matter to him he’s got money for that politician which ever side of the issue he’s on!

Which begs the question that I’m having a real hard time with. Former Michigan Supreme Court Justice Diane Hathaway was sentenced to 12 months and one day in federal prison in a bank fraud case in Detroit and rightfully so, she broke the law.

I guess it really does matter if you are politically connected! I don’t care if you’re a Democrat, Republican or any other political affiliation, black, white, orange, purple or red something just doesn’t pass the justice smell test here.

What is the difference in what David Schostak did and Diane Hathaway? Not a dam thing! When the Michigan Court of Appeals ruled that Schostak’s loan agreement made him personally liable for the $2.1-million difference between the value of his foreclosed property and the outstanding loan balance he found himself in a pickle.

Well Mr. Schostak did what you and I might do in the face of such a judgment assuming that one of our brothers was the chairman of the state Republican Party, and that our family’s real estate company had contributed generously to that party’s elected officeholders.

He enlisted his friends in the GOP Legislature, who quickly adopted a bill excusing him from the terms of the problematic mortgage. Poor Diane Hathaway she wasn’t politically connected! When the law is changed in your favor life is good! Read more…

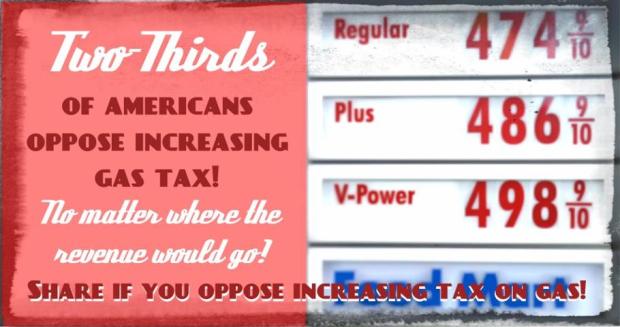

Lansing Republicans Unleash a Flurry of Gas Tax Bills to Increase “Your” Taxes

Posted by rabman13 in Bain Report, Politics, The Bain Report on May 23, 2013

Republican Gas Tax Bills Proposes Over a $1.6 Billion Net Tax Hike

Is it me or does anybody else wonder what these guy’s are “smoking” under that dome in Lansing! Just take a look at the Senate Resolution along with the five other Bills that all have to do with raising our taxes! Rising fuel costs are “strangling the economy” already!

2013 Senate Joint Resolution J: Replace gas tax with higher sales tax

Introduced by Sen. Randy Richardville (R) on January 30, 2013 to impose a 2 percent sales tax increase. At the proposed new 8 percent rate, Michigan would have the nation’s highest state sales tax.

http://www.michiganvotes.org/2013-SJR-J

Senate Bill 84

Introduced by Sen. Tom Casperson (R) on January 30, 2013, to earmark a small amount (0.7 percent) of the new sales tax revenue that would be generated if Senate Joint Resolution J becomes law to a state fund that pays for recreation trails and cleanups. Under current law, this fund gets a small portion of the revenue generated by sales taxes levied on motor fuel.

http://www.michiganvotes.org/Legislation.aspx?ID=152758

Senate Bill 85

Introduced by Sen. John Pappageorge (R) on January 30, 2013, to repeal the state motor fuel carrier tax (diesel tax), and replace it with a 2 percent sales tax increase that (mostly) would be earmarked to roads. This bill is the repealer, and cannot become law unless Senate Joint Resolution J also does, which contains the sales tax hike, and would require a vote of the people.

http://www.michiganvotes.org/Legislation.aspx?ID=152886

Senate Bill 86

Introduced by Sen. John Pappageorge (R) on January 30, 2013, to revise various vehicle registration tax details. Among other things, the bill would change the basis on which the car and pickup tax is assessed. Instead of the basis gradually dropping to 72.9 percent of the list price and staying there from the fourth year on, the basis would become 100 percent of the value when new until the car is 10 years old, when it would drop to 50 percent, a change that would extract approximately $64 million annually from owners. The bill would also end the current one-time $75 trailer registration tax, returning to an annual tax on trailers; those who had already paid the one-time tax would be “grandfathered”.

http://www.michiganvotes.org/Legislation.aspx?ID=152887

Senate Bill 87

Introduced by Sen. Roger Kahn (R) on January 30, 2013, to replace the current 19-cent per gallon gas tax and 15-cent diesel tax with a new tax based on the wholesale price of fuel, initially levied at a rate of 37 cents per gallon. This would also become the minimum gas tax rate even if wholesale prices fell. If wholesale prices rose the maximum tax would be 50 cents per gallon, but the rate could not rise more than a penny in any single year.

When added to current federal fuel taxes and the 6 percent state sales tax also imposed on fuel (revenue from which does not go to roads), this would give Michigan the nation’s highest total gasoline tax levy at nearly 74 cents per gallon, assuming current wholesale and after-tax pump price levels of around $2.74 and $3.50, respectively. (New York is currently number 1 at 67.4 cents per gallon.) Reportedly this would represent a $1.6 billion net tax hike. See also Senate Joint Resolution J, a “Plan A” alternative that would instead hike the state sales tax to 8 percent and use the extra revenue to replace current fuel taxes.

http://www.michiganvotes.org/Legislation.aspx?ID=152888

Senate Bill 88

Introduced by Sen. Roger Kahn (R) on January 30, 2013, to increase the annual vehicle registration (license plate) tax by approximately 80 percent, with comparable increases for trucks and trailers. As an example, the annual tax on a car with a $20,000 list price would increase from $98 to $176 (in the first year, falling to 72.9 percent of this in the fourth and subsequent years). Under Senate Bill 86, the tax would remain at this level until the vehicle is 10 years old (when it would drop to 50 percent). See also Senate Bills 84 to 87 and Senate Joint Resolution J.

http://www.michiganvotes.org/Legislation.aspx?ID=152889

Is the Tea Party Over? The Danger from Within

Posted by rabman13 in Bain Report, Politics, The Bain Report on May 20, 2013

Several examples have surfaced of the Conservative Tea Party movement being attacked, co-opted, vilified and trampled on in this march to reclaim our Freedom and Liberty from an overreaching government. This can only be slowed or even stopped by those “quislings” from within who betrays the cause, state, country and principles for self serving purposes. A quisling is a traitor who serves as the puppet for a political party.

The Republican Party was chosen by the Tea Party movement as a vehicle for change because it was viewed as the weaker party and more closely aligned with their views or at least it’s original intent was. The GOP establishment soon caught on and sent in their operatives as to infiltrate, divide and conquer and co-opt so-called Tea Party leaders and it’s membership. The carrot was dangled to these individuals with perceived access and positions of power within the “good ‘ole boy’s club” and they took the bait!